Barry and Adam wrote and published the book “Guided Retirement Income Planning” in November 2020 to create higher levels of financial literacy and to show a comprehensive and logical process for executing income planning in retirement. Since we believe that this subject matter is so important and relevant, we are going to roll out one chapter each month. While our approach and philosophy will remain consistent in every economic cycle, customization for each household will vary.

We want to emphasize that some of you are not close to retirement and it is never too early to plan. You may also have loved ones, friends, or colleagues that are in need of help. We would be pleased to send them a complimentary copy of our book. We simply hope to help as many people as possible. As we present these chapters, we invite you to circle back to us with any questions or concerns about the content and how it relates to you.

Please enjoy Chapter 11 below! If you missed any of the previous chapters, you can read them all on our blog here.

Regards,

Your Partners at MGFS

Chapter 11

Converting Your Assets into Income (Step 5)

“You can be young without money but you can’t be old without it.” (Tennessee Williams)

In designing a retirement income plan, distribution approaches have to account for longer life expectancies. As discussed in the previous chapter, financial assets need to be managed to navigate through various risks. In Chapter 2, we discussed the three stages in retirement years; go-go, slow-go and no-go. As we plan to convert assets into income, distribution strategies address these risks, the stages of retirement, and the impact of inflation. These approaches should have flexibility for the objective to generate enough income, to fully spend down the assets, or alternatively, to leave a legacy. Following are three core distribution strategies that can be incorporated into a retirement income plan.

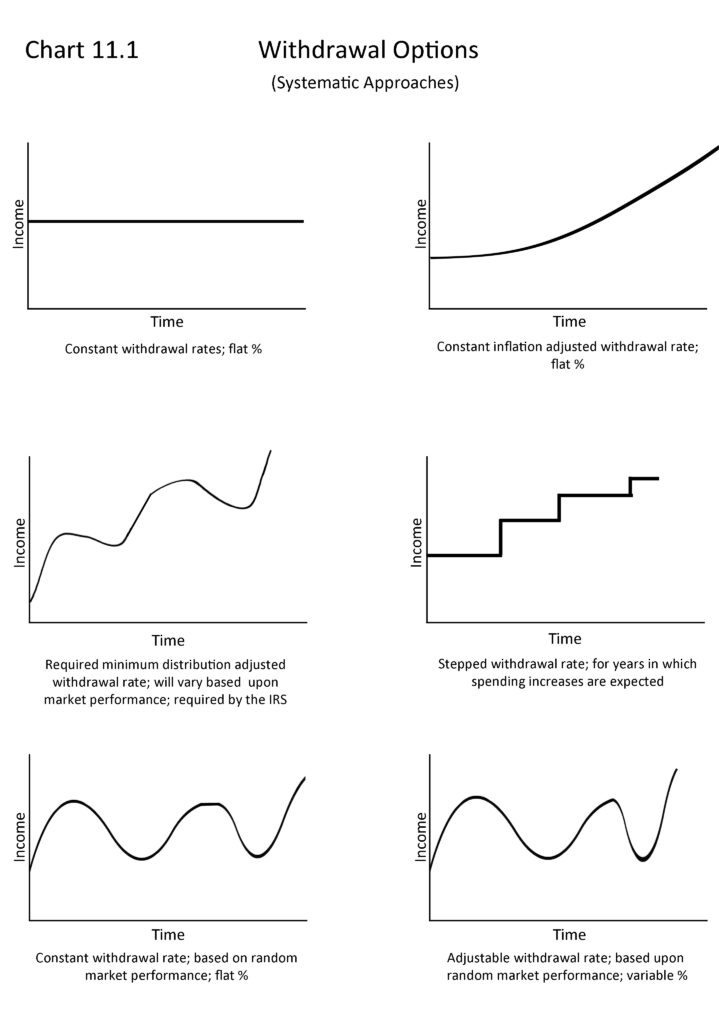

1. Systematic withdrawals – This is a structured withdrawal strategy that is tied to the value of the portfolio at retirement. Depending upon the amount of assets available and the retiree’s lifestyle, the portfolio’s generated income may be distributed without touching principal. Alternatively, principal may need to be withdrawn. This strategy provides predictable cash flow and is consistent. Minor adjustments can be made based on market conditions. The downside is that taking a fixed amount from a volatile portfolio can deplete it quicker when there are bad sequences of returns. See #4 and #5 in the previous chapter – sequence of returns and dollar cost ravaging risk and Chart 11.1 (end of chapter) for various systematic withdrawal options.

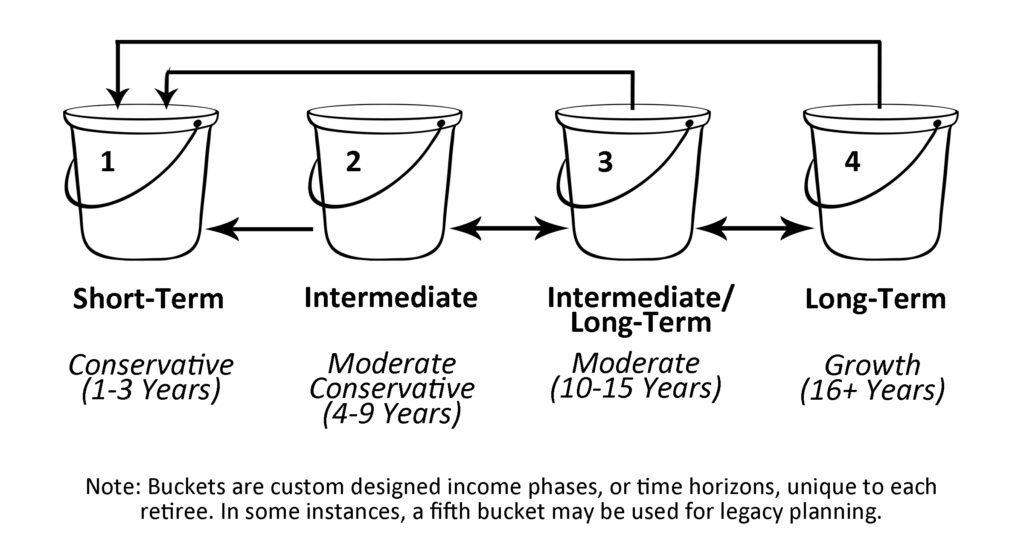

2. Bucket approach – This is a time-based segmentation strategy where separate pools (buckets) of accounts are set up with lowest risk investments held for the short-term, somewhat moderate-conservative or moderate risk investments positioned for the mid-term, and the higher risk investments invested for the longest term. A fourth and/or fifth bucket can also be created depending on the size and use of the portfolio and the projected time horizon. The portfolio structure acknowledges that your portfolio is ultimately to be used for income today and in the future and must invest to overcome inflation. The goal is to provide specific streams of income at specific times. Each investment bucket has its own specific time frame. For example, income is drawn from the lowest risk investment bucket. With ingeniously simple due process, the buckets are periodically rebalanced with respect to market performance and income needs. Segmenting your portfolio into time frames allows you to have liquidity for the short-term and more growth investments positioned for the long-term, future income, and a hedge against inflation. Not only does this minimize sequence of return risk but a retiree can buy and hold their long-term investments (buckets) worrying less about market fluctuations. The short-term bucket creates a time buffer so there is little need to sell off other assets (buckets) invested for longer time frames. The bucket approach works well from a behavioral standpoint, as many retirees tend to understand this intuitive approach. See Chart 11.2 (end of chapter) to visualize how this could look.

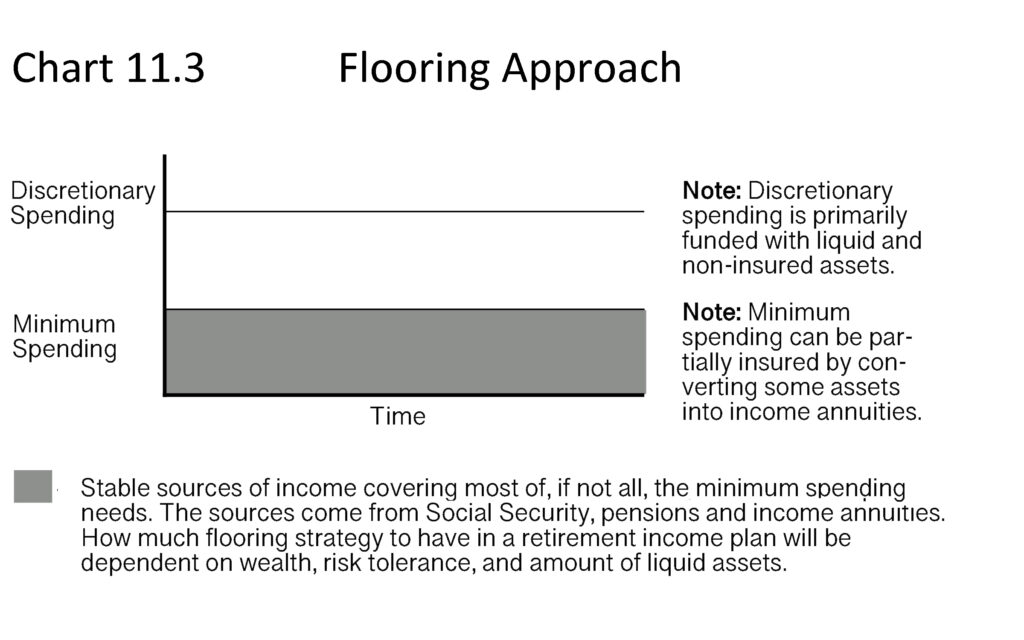

3. Flooring (safety first) approach – The purpose of this strategy is to establish stable income to cover your essential spending needs. Social Security, pensions, and income annuities, when available, are most often used to create a “floor” and satisfy those spending needs. When these sources do not provide enough income, a portion of the portfolio can be allocated into non-guaranteed or low risk investments such as laddered fixed income strategies.

Dually, some investments used for a flooring approach may help mitigate longevity, market sequence of returns, and excess withdrawal risks. However, having too much in this strategy will impact portfolio growth and liquidity. See Chart 11.3 (end of chapter).

When thinking about which strategy is most appropriate for your circumstances, you will take into consideration whether you have sufficient assets or abundance. In many instances, a combination of two or more approaches will help provide your required income and the peace of mind necessary to enjoy retirement.

Words of Wisdom on Aging

You don’t stop laughing when you grow old, you grow old when you stop laughing. (George Bernard Shaw)

He who is calm and happy-natured will hardly feel the pressure of age, but to he who is of an opposite disposition, youth and age are equally a burden. (Plato)