2nd QUARTER 2022

Happy Summer! For the second quarter report, we will focus on the following topics:

We have been rolling out a series of special reports on inflation and will continue to do so over the next few months. Our objective is to raise awareness, and to explain cause and effect, history, and strategies to minimize risks in your financial life and portfolios. You may also search for “inflation” content and many other topics in our blog at https://mgfs.net/category/blog/. |

What’s on your mind? |

We know you are concerned about inflation since prices are up everywhere and for everything. You have been asking us if the economy is in a recession or heading in that direction. You are concerned about market volatility, falling asset prices, and higher interest rates. As always, we will do our best to address these topics. |

Inflation and the Economy |

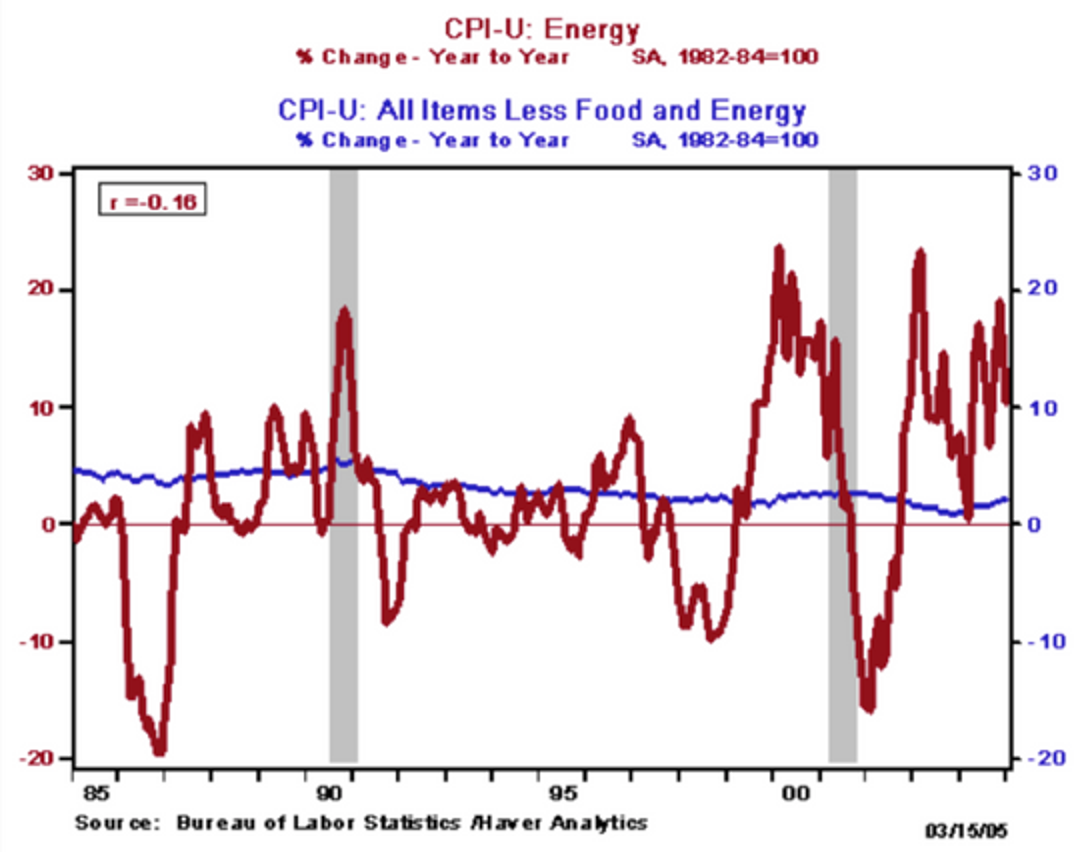

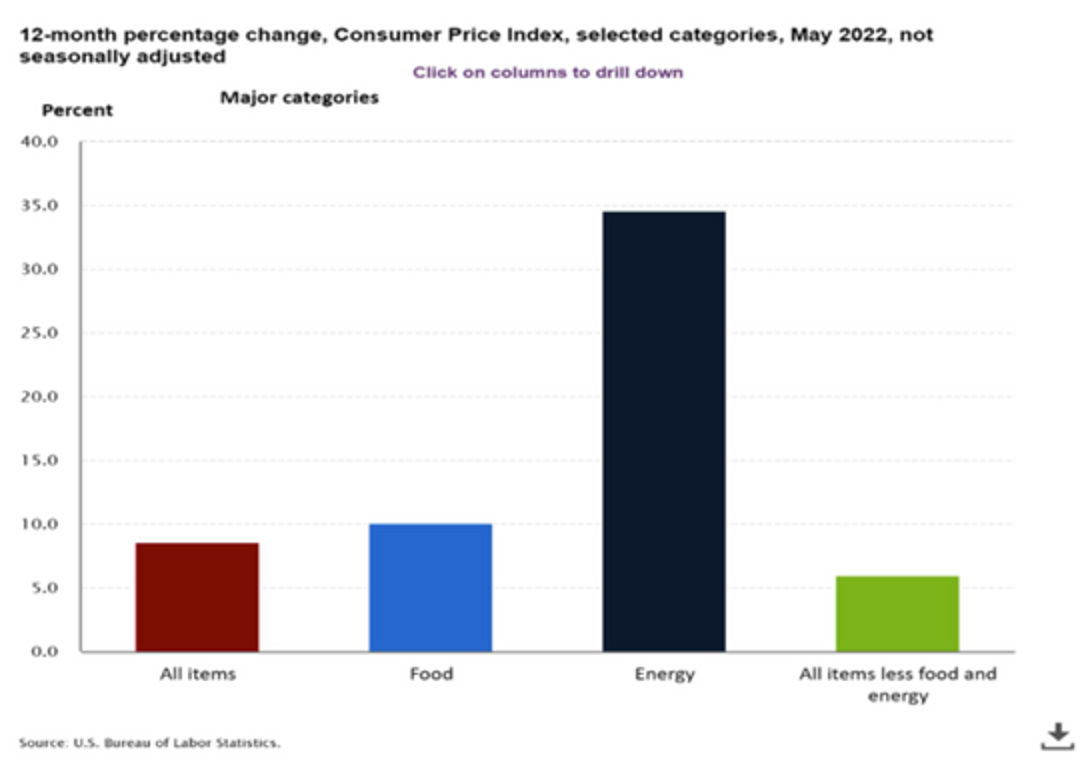

Inflation– While the current reported CPI, consumer price index and measure of core inflation, reflects an inflation rate of 8.6%, we want to remind you that food and energy costs are not included in these numbers. You may find it interesting that such costs are considered volatile, and often their associated prices correct in short periods of time (See Chart A below). When added to CPI, the measure is referred to as headline inflation. Food and energy prices are much higher than all other goods and services today (see Chart B below). |

Chart A |

|

Chart B |

|

Also, the producers price index (PPI) in the last year has gone up 10.8% according to the Bureau of Labor Statistics. What this tells us, whether you believe core or headline inflation should be referenced, is that production costs have increased by more than core inflation; it is reasonable to conclude that either the supply of goods and services will either need to increase to meet consumer’s post Covid pent-up demand an bring prices down or inflation will likely rise to reflect increased production expenses. We will have to wait to find out. In terms of energy prices, the price of gas has skyrocketed in the last few months and has come down a tick. As the price of oil has come down and moratoriums on oil production have been lifted by the government, you may wonder why gas prices are still high. This is complicated and political. Oil needs to be refined and many refineries were shuttered during COVID. They are not easy to bring on-line and the oil companies are required to purchase energy production credits (EPCs) from the government to do so. From the oil companies’ perspectives this requires a big, expensive lift, essentially, a tax. From the government’s perspective, the oil companies are holding the public hostage to profit margins. The lay consumer, experiencing strong inflation, is simply concerned with the way in which gas prices are being handled. For instance, you may wonder about the timing associated with morally and environmentally correct revenue generation from EPCs to support a green future at a time when the average household is experiencing an increase in food and energy expenses by more than $400 per month. While the Biden administration has pivoted and is pushing for a temporary gas tax relief, the ultimate impact it would provide is minimal, lasting a few months. Let’s hope that food and energy costs will come down with strengthening supply chains or some other form of positive intervention. To tackle and lower inflation, the Federal Reserve (Fed) is now in the process of gradually raising interest rates and have signaled their willingness to continue this trend over the next few months, perhaps much longer, if needed. Higher interest rates will result in increased borrowing costs for mortgages, lines of credit, adjustable loans, and credit cards. If you put on your business owner hat this also means the costs of goods and services must go up. If you consider rate increases as an investor, you will be able to secure higher rates in the not-too-distant future. Inflationary and, alternatively, recessionary environments are very challenging for most of the public in the short-term. In the past two years alone, the Fed has purchased more than $4.5 trillion of securities which has bloated their balance sheet, added more liquidity into the economy, and artificially held interest rates low. The Fed has announced that it intends to sell $47.5 billion of securities in July and August, then it will increase monthly sales to $95 billion beginning in September. By selling, money comes out of circulation (via purchases). The goal is to decrease the money supply, slowing spending and inflation. The tricky part is reducing inflation while limiting risks to the economy. With their overtly stated objective of slowing down consumption, the Fed’s goal is much easier said than done. |

The EconomyStatistics are mixed. The good news is that corporate profits for many blue-chip companies remain solid. The labor market is strong with an abundance of available job openings nationwide. A tighter labor market will result in rising wages. Globally, the US economy is better positioned than countries in Europe and Asia. Consumers still have strong savings. While debt levels are healthy, they are inching up. Consumer sentiment is at an all-time low. Ironically, this is a contrarian, positive indicator for the long-term investor. We contend all investors necessarily maintain a part of their portfolio for the long-term to keep up with inflation, taxes, and generational security or wealth. Higher interest rates will slow down the housing market. New home sales are down significantly from their peak approximately two years ago. Yet demand remains strong, stabilizing if not driving up prices in sunshine states and those that are friendlier to residents’ pocketbooks. Are we in a recession now? It is a possibility since the first quarter GDP was negative and the technical definition of a recession is two consecutive down quarters. We’ll know later in July. The economists and analysts that we follow are divided on the issue. The consensus is that if we are not in a recession in 2022, there is a greater probability we will be in 2023/24. The Fed’s monetary policy decisions are driving in that direction. Our most recent conversations with JP Morgan give us hope for a recession with a soft landing, one that is light and short. Economist Bob Genetski’s has an interesting and contrasting theory. He believes that regulatory burdens are creating significant challenges for businesses and could result in more widespread shortages of goods and services. As a result, less spending at the beginning of a cycle with bad economic news, the Fed may be inclined not to raise rates, a positive for financial markets. |

The Markets |

As you are ware, the markets (bonds and stocks) are down since the beginning of the year. As of this writing, the year-to-date performance of the S&P 500 hovers in the minus 20% range. The high-tech Nasdaq index is performing worse, closer to minus 30%. An interesting fact, however, is that all but the top 10 stocks in the S&P 500 are “averaging” a 50% decline in performance from their peak. How so? The S&P 500 index is weighted by company size. So, the better performing, 10 largest companies offset the performance by the other stocks to create an average closer to -20%. Overall, every major equity index is negative year to date. If you have reliable cash flow, whether accumulating wealth or in retirement, and cash on the sidelines, this is a buying opportunity. The US aggregate bond index is down over 11%. There is no relief from the other bond indices. This has been the worst first half of the year performance for bonds on record. Thankfully yields below 1% at the end of last year are now closer to 3%, more or less depending on the type of bonds. The middle and long ends of the yield curves reflect a measure of bond volatility being priced in the market already. It will be nice to experience collecting higher yields and seeing their impact in statements, after such a long time not being compensated for conservative investments. In terms of sector performance, smaller parts of the S&P 500 market, the energy sector is the only area with positive performance. Energy is up over 30%. The only sectors worth noting with only moderate losses at close to 10% are the utility and consumer staples sectors. |

Our Views |

With every research firm we follow, there appears to be a variety of opinions about the short-term direction of inflation, the economy, and interest rates. Economic and market forecasting is more challenging than usual since the data points are in a constant state of flux. We believe higher inflation is more likely to continue for the next couple years. That also means that interest rates will be increasing in the short term. One area that we are watching closely is food prices, with particular concern over fertilizer per the US Department of Agriculture in March 2022. “Fertilizer prices have more than doubled since last year due to many factors including (Vladimir) Putin’s price hike, a limited supply of the relevant minerals and high energy costs, high global demand and agricultural commodity prices, reliance on fertilizer imports, and lack of competition in the fertilizer industry.” The additional overhead burden to farmers, manufacturers, and retailers would also be passed on to consumers through higher prices and potential food shortages. While we hope this self corrects, basically, price inflation would likely increase. We are not saying you should run to the aisles at your grocery store, but we are saying this is a potential impact from inflation and therefore important to consider. It does seem likely that the economy will experience a recession(s) in the next few years due to the Fed’s objectives with monetary policy. In saying this, your impact from inflation, recession(s) or both will be different than how your neighbors may be affected. Thankfully, many of you have taken the time to plan, have sufficient cash reserves, and maintain a regular dialogue with us to structure your portfolios for your needs and desires over time. We expect the market to remain choppy and anticipate the market will be up in no more than a few years and certainly for the long-term. There are great buying opportunities as many companies become priced at or below fair value. Today, many companies are below their fair values AND the largest 10 companies that have been less affected by the market remain closer to 120% of their fair prices, therefore overvalued. We still like many of these underpriced companies and these industry leaders! Well-run companies will remain profitable and good long-term stock investments. Bond coupon rates will continue to rise making them more attractive going forward as they mature and are reinvested. Like any economic or market cycle, this one will end, and another long-term bull market will follow. No one, including us, can be sure when that will happen. We assert as always, please continue to plan. One more note on inflation in the spirit of the mixed, yet optimistic, messages. The above comments suggest inflation will remain high, whether prices adjust modestly or continue increasing at the current pace. A countervailing consideration is that inflation comes down with interest rate hikes and both demand and the supply of goods and services reach an equilibrium point. Stated differently, supply catches up to today’s outsized demand. Be patient and calm during these volatile times but engaged in the planning process. We can adjust your portfolios, but we must be thoughtful in what we do and how we do it. There are unintended consequences with bold moves in the middle of an economic storm. We prefer to help you maintain portfolios that are current and relevant to your plan and make modest adjustments, as appropriate. We have added several asset classes to those clients with advisory accounts. For taxable accounts, we are in the middle of analyzing whether or not to harvest portfolio losses to offset taxable capital gains. For some clients this may minimize tax liabilities. In these instances, this strategy is in our control and can improve bottom-line performance. Please reach out to us with any questions or concerns. We are always here for you! |

Notable Quote |

We love the following quote as realists inspired with optimism. William Arthur Ward, an American motivational writer states “the pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.” In other words, be mindful of the environment we are in. Let’s control what we can, adjust our spending patterns, if necessary, assess thoughtful adjustments to your portfolio, monitor your goals and risk tolerance. |

Much health, wealth, and happiness to you

and your families for the rest of the year!

Your Partners with MGFS

With gratitude to serve your needs…

Barry E Moschel, Partner, RICP®, CLU®, ChFC®, CPA

Adam L Schwartz, Partner, CFP®, NSSA®

Tom Manno, Partner, CFP®, CPFA™