Barry and Adam wrote and published the book “Guided Retirement Income Planning” in November 2020 to create higher levels of financial literacy and to show a comprehensive and logical process for executing income planning in retirement. Since we believe that this subject matter is so important and relevant, we are going to roll out one chapter each month. While our approach and philosophy will remain consistent in every economic cycle, customization for each household will vary.

We want to emphasize that some of you are not close to retirement and it is never too early to plan. You may also have loved ones, friends, or colleagues that are in need of help. We would be pleased to send them a complimentary copy of our book. We simply hope to help as many people as possible. As we present these chapters, we invite you to circle back to us with any questions or concerns about the content and how it relates to you.

Please enjoy Chapter 7 below!

Regards,

Your Partners at MGFS

Chapter 7: Evaluate Your Current Situation - Spending Needs (Step 2-A)

“Beware of little expenses. A small leak will sink a great ship.” (Benjamin Franklin)

Once you consider what retirement could look like, and how your priorities and interests may change, then you will need to calculate your anticipated expenses. The best place to start is with your current spending. You will need to account for your expenses and categorize them under needs and wants. Once you categorize them, it will be easier to understand your monthly cash flow needs. Your budget can then be adjusted to include extra expenses for traveling, paying off your house within a few years, relocating, etc. The first step in evaluating your expenses is to review your monthly spending. Below are many categories. Some expenses are annual or semi-annual such as property taxes, while others are periodic, such as clothing. To provide uniformity, you will need to convert these expenses to a monthly amount so that you can determine how much monthly income is needed. Regardless of your sources of income (to be discussed in the next chapter), this process will form the basis for your budget. A budget is more than a listing or understanding of your expenses. It is how you will take care of your expenses and not overspend. The budget will become a baseline of what you can afford and encourages you to make decisions about needs and wants and actions necessary to maintain your lifestyle. You will change your budget as your spending patterns evolve in retirement. Sometimes the categories will be estimates. It is okay to round up a little on the expenses to give yourself a margin of error – a little extra cash! The list below is a comprehensive overview of expenses: HOUSING

FOOD

LIVING EXPENSES

HEALTHCARE

TRANSPORTATION

GIFTS

TRAVEL

TAXES

OTHER INSURANCE

EDUCATION RECREATION

|

Remember that these expenses are either essential “needs” or discretionary “wants” and you will want to categorize them to budget and make adjustments based upon your income. For example, travel is considered a discretionary expense while food and electricity are essential expenses. If future budgets become tighter, it is easier to reduce discretionary spending first. This exercise can be tedious. However, this is part of the process of increasing financial literacy and taking a deep dive into spending patterns. The truth is that adding more discipline and structure to the planning process creates more awareness and long-term financial stability. If you have accumulated or are increasing credit card debt, you will need to analyze this in greater detail. Interest rates can be extremely high and costly. In retirement, depending on your level of wealth, other than perhaps a home or a car, it is best to be debt-free. Planning to pay off any excessive or unproductive debt should be part of the planning process. Related Topics Let us now cover a few important matters about insurance coverage since these are essential needs and collectively may be expensive. Usually insurance is purchased to protect against large and unaffordable risks. You will want to periodically review property and casualty, auto, and umbrella liability insurance policies for adequacy with a quality property and casualty insurance consultant. Sometimes raising deductibles can save premiums. Balancing deductible levels and the amount of insurance needed will ensure you are maximizing protection while minimizing current expenses. Identity theft protection is becoming more commonplace and should also be strongly considered. You want to minimize your risk and exposure in this area. There are numerous companies that can monitor your credit and identity. They can protect you from identity theft and help you if your identity is ever compromised. See more about cyber-security in Chapter 10. Health insurance is always considered an essential expense that needs to be revisited regularly. For those older than 65, Medicare Part D (prescription drugs) plans should be reviewed for changing needs:

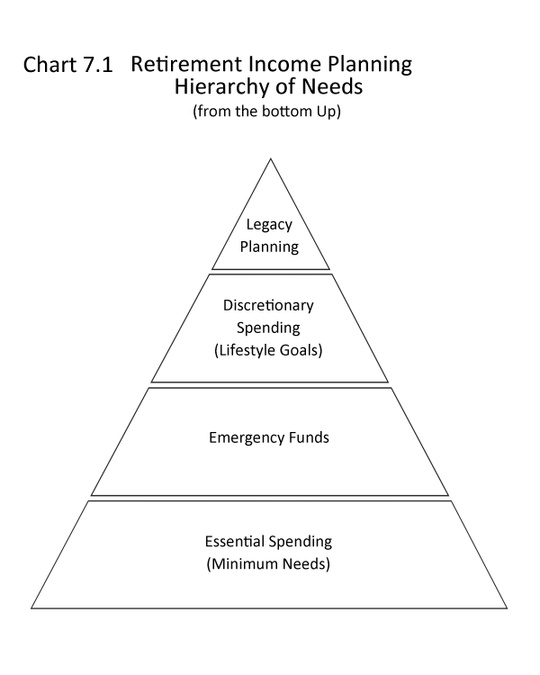

It is recommended that you consult a trusted health insurance specialist to obtain and maintain the proper coverage particularly when you either retire or turn 65 years old. The insurance specialist can also help compare the differences between traditional Medicare and Medicare Advantage Plans. See the Hierarchy of Needs chart (Chart 7.1). It provides a quick overview of how retirement should be funded in terms of priorities. The chart shows the foundation of retirement income planning is to first cover essential spending needs. Maintaining an adequate emergency fund allows quick access to cash to cover expenses that are either cyclical or unexpected. These funds should be kept in non-market, interest-bearing cash accounts for safety and protection. The amount of emergency funds will vary from household to household depending upon your needs and comfort level and should be coordinated with the rest of your retirement plan. Discretionary spending is accounted for next while legacy planning comes last. It is very important to note with people living longer, that staying healthy for as long as possible in retirement will help achieve and maintain lifestyle goals. You should consider investing in healthcare, exercise, and nutrition for good health and happiness. With the understanding that your spending needs will change over time, please revisit your budget regularly so that your ultimate income plan can also be adjusted, as needed. |

Words of Wisdom on Life from Abraham Lincoln

- In the end, it’s not the years in your life that count. It’s the life in your years.

- Most folks are as happy as they make up their minds to be.