Barry and Adam wrote and published the book “Guided Retirement

Income Planning” in November 2020 to create higher levels of financial

literacy and to show a comprehensive and logical process for executing

income planning in retirement. Since we believe that this subject matter is

so important and relevant, we are going to roll out one chapter each

month. While our approach and philosophy will remain consistent in every

economic cycle, customization for each household will vary.

We want to emphasize that some of you are not close to retirement and it

is never too early to plan. You may also have loved ones, friends, or

colleagues that are in need of help. We would be pleased to send them a

complimentary copy of our book. We simply hope to help as many people

as possible. As we present these chapters, we invite you to circle back to

us with any questions or concerns about the content and how it relates to

you.

Please enjoy Chapter 5 below!

Regards,

Your Partners with MGFS

CHAPTER 5

PUTTING TOGETHER A RETIREMENT INCOME PLAN

“We must consult our needs rather than our wishes.” (George Washington)

A well-designed retirement income plan is a critical process that will help

you prepare for retirement. It does not happen in a vacuum and can be

difficult to create. This process of putting together a retirement income

plan is orderly and systematic. It can be tedious, complex, and

overwhelming. You will need to adjust your thinking because, as stated

earlier, accumulating wealth while you are working is a different mindset

than taking distributions.

Retirement planning should be customized and unique to your household.

When to get started is also dependent upon your circumstances. The

biggest advantage to starting early, say five or ten years prior to

retirement, is that you can start to make intelligent and well-informed

decisions to help turn your dreams into reality. Proper planning not only

includes investment considerations but also extends to relevant risk

management and tax strategies. Some considerations to increase your

retirement readiness:

- Risk management strategies related to life, disability, homeowner’s

and liability insurance coverages; wills and trusts. - Long-term care coverage when one is healthy and able to afford it.

Long-term savings with qualified retirement plans and after-tax

accounts. - Tax exempt or tax favorable strategies such as Roth accounts, Roth

conversions, cash value life insurance, and annuities. - Employment decisions related to pensions, employee benefits, and

portability.

So where should you begin? Retirement income planning is goal and

budget-based and is about having a plan to convert assets into income

and making it last as long as needed. It’s about managing through risks,

uncertainty, and turbulent times and being able to make proper

adjustments along the way. First and foremost, you will need to consider

what is most important as you enter retirement. From there, it’s about

identifying the obstacles and possibilities, and the best way to implement

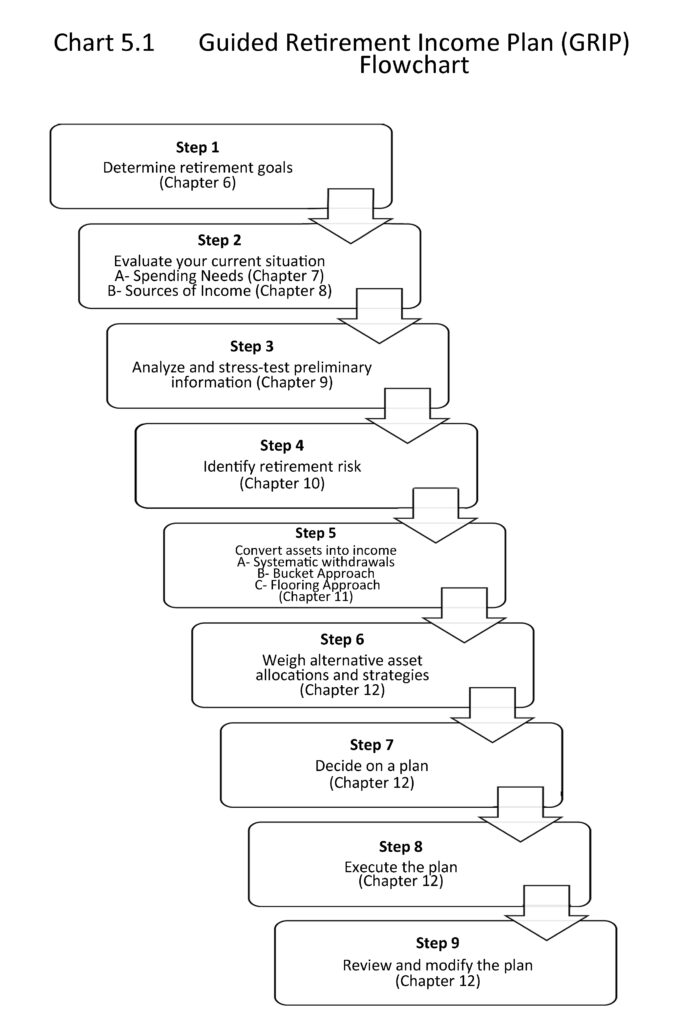

the plan with continual monitoring. Following is an outline of the specific

steps to create a retirement income plan (see Guided Retirement Income

Plan Flowchart – chart 5.1). Subsequent chapters will expand on each of

these steps.

Step 1 – Determine retirement goals – There are many qualitative

questions that require significant thought and soul searching. Here are a

few:

- What is your vision for retirement?

- What are your retirement goals, expectations, and objectives?

- What is the anticipated timeline for retirement and what needs to

- happen before retirement?

- Do you have a plan to transition into retirement?

- What emotional and personal factors should be considered?

- Will you have financial, logistical, and even physical obligations to

- help a loved one?

- Will you be relocating and if so, will this be closer to or farther from

- family?

- Is downsizing a home or moving into a retirement community

- important?

- What are your biggest fears leading into retirement?

- What are your biggest priorities – travel, multiple residences, a new career, going back to school, consulting, part-time or volunteer work…?

Please see the Retirement Planning Survey in the appendix as an

expanded resource to help you identify your goals.

Step 2 – Evaluate your current financial situation – In other words,

assess your financial net worth – your assets and liabilities; cash flow

reflecting income sources and expenses need to be inventoried and

categorized. Do you have a pension or have you created one for earlier

or later use in retirement? Have you considered your best options with

social security?

Step 3 – Preliminary calculation – This is a preliminary forecast of

income needs and expenses to determine if there are any projected

income shortfalls. A rough monthly budget will be necessary to start the

planning process. Categorizing these expenses into needs (essential

spending) and wants (discretionary spending) is highly encouraged. All

income and potential income sources are factored in, as well. The object

is to get a quick snapshot of your cash flow to determine if retirement can

be properly funded or if there are shortfalls that need to be addressed.

Retirement income software is very helpful to forecast and stress test

future cash flows. The software projections should incorporate the

following: how much income is needed, ages of retirees, projected life

expectancy, inflation, taxes, target long-term investment returns, and

should simulate the impact of market volatility. The software data can be

modified to change the variables, which in turn, will change the results.

Why is this important? Life is about choices. One choice can impact

another. Seeking certain lifestyle priorities beyond minimum spending

needs may alter outcomes elsewhere in your plan. It is important to note

that such projections serve as a benchmark to make sound financial

decisions. If there is a shortfall in the plan, it is better to know right away

and take corrective action early.

Step 4 – Identify retirement risks – There are many risks that could

derail a retirement income plan. For example, how do you define risk? Is it

seeing your assets fluctuate in value, not being able to buy things in years

to come for the same price as you can today, or is it outliving your

money? Later, we will address these risks in more depth. The important

concepts to understand are that there are numerous strategies and

management techniques to address these risk factors; it is important to be

open and honest about potential risks, and to recognize the biggest

concerns so that they can be addressed with suitable solutions.

Step 5 – Convert assets into income – There are three standard

approaches to convert assets into a sustainable income plan. One or more

of them will hopefully be implemented prior to entering retirement;

systematic withdrawals, bucketing, and flooring. We will review these

approaches in greater detail in Chapter 11. Whether one or a combination

of the approaches is used, the sequence of withdrawals should be

optimized within the plan because social security and pension timing need

to be factored into the calculations. After completing these steps, the plan

can be modeled again using retirement income software to forecast and

stress test it under different market conditions and personal scenarios.

Step 6 – Weigh alternative asset allocations and strategies – Evaluate

different investments, risks, portfolio management approaches, and then

payoffs. This is where you start to narrow down the options!

Step 7 – Decide on a plan – Choose a plan that addresses the most

important concerns and feels comfortable.

Step 8 – Execute the plan – Simply stated, put it into action!

Step 9 – Periodically review and revise the plan – Identify how the plan

should be reviewed and how often this should be accomplished.

These steps seek to provide comfort and confidence in order to transition

from work to retirement without the financial, mental, or emotional anxieties

that others may experience without a plan. Being prepared for retirement

will enhance your excitement and happiness. At the end of the day, isn’t

that the ultimate goal for retirement?

Words of Wisdom on Life

At age 20, we worry about what others think of us. At age 40, we don’t care what they think of us. At age 60, we discover they haven’t been thinking of us at all. (Ann Landers)