Barry and Adam wrote and published the book “Guided Retirement Income Planning” in November 2020 to create higher levels of financial literacy and to show a comprehensive and logical process for executing income planning in retirement. Since we believe that this subject matter is so important and relevant, we are going to roll out one chapter each month. While our approach and philosophy will remain consistent in every economic cycle, customization for each household will vary.

We want to emphasize that some of you are not close to retirement and it is never too early to plan. You may also have loved ones, friends, or colleagues that are in need of help. We would be pleased to send them a complimentary copy of our book. We simply hope to help as many people as possible. As we present these chapters, please circle back to us with any questions or concerns that you have about the content and how it relates to you.

Please enjoy Chapter 2 below!

Regards,

Adam L Schwartz, Partner, CFP®, NSSA®

Barry E Moschel, Partner, RICP®, CLU®, ChFC®, CPA

Tom Manno, Partner, CFP®, CPFA™

Chapter 2: WHY THE NEED FOR RETIREMENT INCOME PLANNING

“As in all successful ventures, the foundation of a good retirement is planning.”

(Earl Nightingale)

Now that you understand the importance of financial literacy, you need a vision. So many people retire without one and without a plan. Retirement income planning begins to take place with this vision and should incorporate how you are going to meet your spending, lifestyle, and legacy goals.

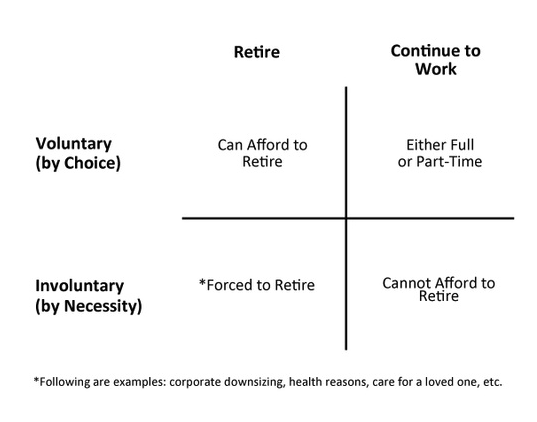

Retirement is not the same for everyone. Chart 2.1 (end of chapter) is a simple matrix that illustrates categories of retirement readiness. Ideally, you want to be in the top voluntary quadrants and have control over your future. Having a plan can help you reach that goal.

Retirement is also an evolution over time as it consists of a series of cycles. Life at 90 will look very different than life at 65. These phases are different for every individual but in general they can be categorized in the following ways:

- Go-go years – You are early in retirement, active, healthy, and energetic. You are at the height of your leisure spending and potential travel.

- Slow-go years – You are aging and slowing down somewhat but are still relatively healthy and independent. You are traveling less and spending less on lifestyle.

- No-go years – You are not as healthy and may not be as independent. You are approaching the later years in retirement and life. Your spending is down and healthcare costs are higher.

As discussed in Chapter 1, retirement planning takes what is known and helps you prepare for what is predictable and unpredictable. Your retirement will expose you to a variety of financial risks such as inflation, unforeseen expenses, market volatility, life expectancy/longevity, increasing healthcare expenses, long-term care needs, and potentially, death of a spouse. You need to have a retirement income plan for the following reasons, (as if the risks weren’t enough!):

- Having a plan will instill confidence, if taken seriously. This becomes a roadmap and methodology to analyze and compare where you are to where you want and need to be. It also provides a mechanism to periodically reassess current cash flow needs, strategies, and portfolio allocations. With every roadmap you will want to take pit stops and refuel during your long journey!

- It simplifies complexity. Sometimes you have to be flexible and adapt to current events. You will need to consider and coordinate many moving parts.

- The stakes are extremely high. Portfolio failure means running out of money later in life. Planning seeks to support the “pursuit of financial independence.”

- It can provide a happier and more successful retirement. Although much of the financial modeling and literature analyzes the probability of success, to a retiree the outcomes over a lifetime will be binary. It will either be successful or not. The best way to ensure success is to have a realistic plan with reasonable expectations and to make suitable adjustments along the way. It is usually easier to make the necessary cash flow and portfolio changes earlier in retirement while there are more assets and time to recover than later in retirement, when assets may be depleting at a faster pace than desired.

- A plan will coordinate withdrawal strategies and converting assets into income, with other sources of income such as social security and pensions. Tax strategies will be considered to sequence assets to generate income while preserving wealth.

Building a plan is not a “once and done project.” Instead, it is a dynamic and ongoing process. It takes time, goal setting, and various action steps. Budgeting is important to estimate cash flow needs. A plan should accommodate minimum spending needs, lifestyle/discretionary spending, an emergency fund, and legacy or estate planning. It works best if there is a periodic review to determine if a plan is on track. If it isn’t, the plan may need to be modified or expectations reassessed.

You may find it difficult to manage a plan independently because, left unattended, a plan can go awry. You go to your doctor for medical checkups and it is also important for you to go to your financial advisors for a financial checkup. A good financial advisor will partner with you to provide clarity and to help you help yourself. A good financial plan has to accommodate both emotions and behavior. The ultimate goals for your plan are to help you maintain dignity, control, independence, and confidence with your standard of living. Your retirement income plan will be customized to last and, potentially, to produce a legacy, if desired.

Chart 2.1 Retirement/Work Matrix

The Lighter Side of Longevity from Mel Brooks

The 2,000 year old man’s secret of longevity:

- Don’t run for the bus – there’ll always be another.

- Never, ever touch fried food.

- Stay out of a Ferrari or any other small Italian car.

- Eat fruit – a nectarine – even a rotten plum is good.