What’s on your mind?

In our conversations, we know that many of you are asking about the ‘R’ word: recession. Are we headed towards one? If so, how severe is it going to be? What does inflation look like in the upcoming year? How will it impact stock and bond markets?

Economy

Most signs are pointing to a challenging year for 2023 and a difficult one to forecast. The economy is starting to feel the impact of the prolonged and abrupt pandemic lockdowns in 2020 and 2021. During that same time period, the Federal Reserve (Fed) increased the money supply (defined as M-2) by over 40% and then made a 180-degree turn with aggressive rate hikes to stave off inflation. We have used the following analogy to help you visualize what is happening. Suppose you had a severe car accident and you were injured. Instead of treating the symptoms, the medical professionals just give you painkillers and do not treat the underlying medical conditions. Now, as the effects of the medication are finally wearing off, you start feeling the pain as the symptoms persist. Today, the economy is the patient. The Fed injected massive amounts of cash into circulation and then decided they may have overdone it – hence the rate hikes. Now, we are all feeling the effects.

Additionally, there are fiscal policies that will act as additional headwinds in 2023. These include high regulations, increased taxes, and massive increases in government spending. While very focused on social equity, the inertia behind these changes have formed a paradigm shift for the economy and will most likely lead to lower productivity and lower corporate profits in many sectors. A slowing economy will generally lead to higher unemployment.

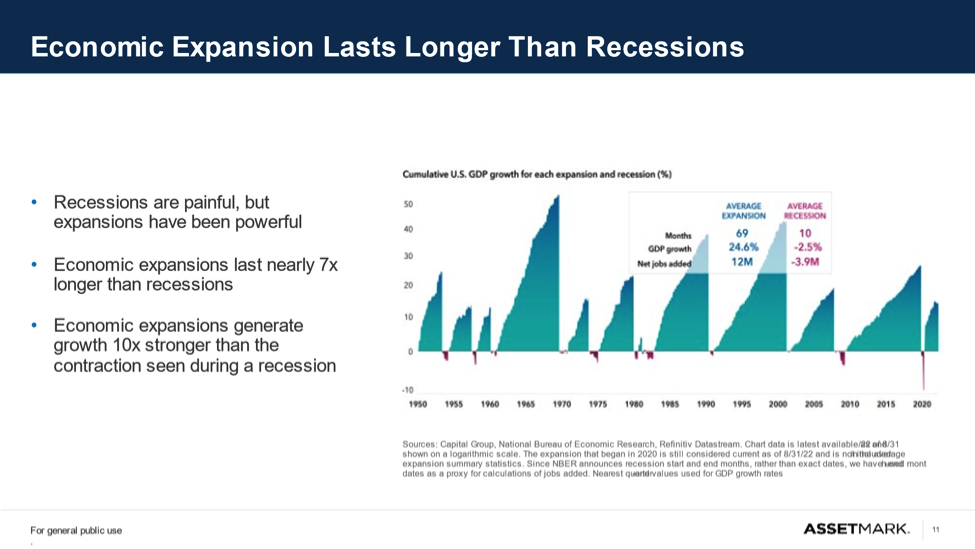

The growing consensus seems to be that a recession may occur in the earlier part of 2023 and will not be as severe as some had previously predicted. Please remember that economic downturns are normal and cyclical. We have been through these before and these cycles will rotate and become positive again.

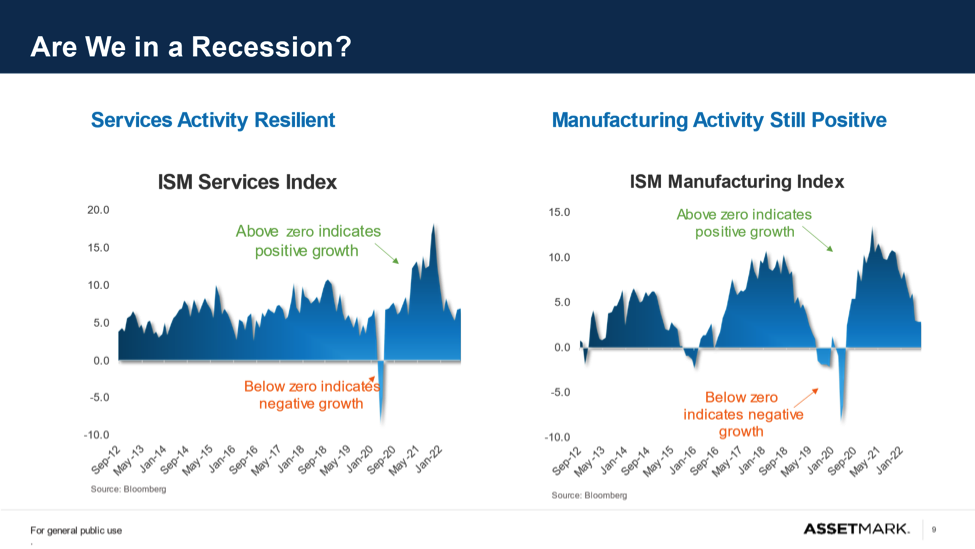

We thought you might appreciate this slide reflecting where we are today. Are we in a recession?

Inflation

While the data appears to indicate that inflation has started to decline slightly over the past three months, the jury is out on the Fed’s next moves. Inflation is still 6.5% and way over the target rate of 2%, while the Fed is rumoring they may raise the target rate closer to 3% . Many economists believe that the Fed will continue to raise interest rates to reduce inflation. We believe, with minimal consequence, the Fed has little room to raise rates before the weight of carrying national debt to higher interest rates becomes outsized against the revenue we generate as a country.

There is another area that economists are watching carefully. Currently, the Fed has a bloated balance sheet with member banks holding an unprecedented amount of cash reserves under tighter regulatory restrictions. If the Fed continues its restrictive monetary policy to combat inflation, their actions could be neutralized when the member banks circulate their excess reserves in the form of bank loans. These loans would add money back into the economy, which would generate the opposite outcome, as it would be inflationary.

We are in uncharted territory as it relates to how the Fed manages monetary policy. The most recent and exorbitant money-printing has resulted in the Fed having an abundance of reserves on their balance sheet as opposed to historically having minimal reserves. There is no question that austerity measures were needed when the economy shut down. But was the financial support unchecked? We think of the stories in the 80’s about the government paying $8,000 for an average screw/hardware to fix a problem. It is this level of inattentiveness that draws our concern. To restate, we are in uncharted territory as it relates to the Fed having an abundance rather than scarcity of reserves in an inflationary environment. No one is quite sure if the Fed will be able to safely navigate the economy and inflation into a soft landing, without greater, negative, unintended consequences. They believe they can. We hope they are right. Time will tell.

Markets

While we know that higher interest rates and slower GDP growth will affect corporate profits, the impact should continue to result in ongoing market volatility through at least the first half of 2023. In terms of anticipated equity performance, there are always companies or sectors that are more favorable than others. Growth sectors such as technology have most certainly led the way from 2009 to late 2021. Since then, the market has braced for corrections from over-prosperity and liquidity in the market, a.k.a. inflation. This is a time for companies, long out of favor, with strong dividends found in defensive, “needs-based” sectors to perform. We have become accustomed to a few large companies dominating and driving market performance. Going forward it is not time to place bets on one part of the market, a handful of previously performing companies, or a rotation to another small group of companies. We refer to this as speculation. It is important to have thoughtfully diversified and managed portfolios. A younger client can tolerate more growth. An older client with plenty of investable assets and a long-time horizon can assume a healthy weighting in growth. Those who are planning and not quite there or concerned about remaining secure need balance. We want to remind you though that while many economic indicators such as GDP, unemployment, and CPI look back in time, the stock market is forward-looking and will begin to recover before the economy. Planning with diversification for your needs will help your portfolio flourish.

The bond market had its worst year in 2022, down more than 13%. The next three closest poor performance years over the last 40 were down approximately 3%. Bond math is very clear that higher interest rates should soon lead to more price stability as interest rates level off. The maturing lower coupon rates are being repositioned and replaced by higher, competitive, new coupon rates. Bond yields will be competitive once again and a good source for income. Higher income levels will help with portfolio recovery and increase the value of bonds, as well. We are seeing this now!

Reasons to stay invested

Even during periods like this, with higher inflation, rising interest rates, increasing layoffs, a possible recession, and continued market volatility, there are many reasons to stay invested. Here are a few of them.

To touch upon above, many companies can thrive during times of adversity. For instance, some companies, like credit card companies, take advantage of higher interest rate cycles. When there is less economic productivity, consumer staples companies like Colgate-Palmolive, which focuses on household and personal care, historically hold up well. Utilities, Energy, and Healthcare often perform competitively, as well. Keep in mind that investing is for the long-term. Stocks hedge against inflation more so than bonds over a business cycle.

Money managers will fall back on fundamentals such as cash flow, balance sheet, debt ratios, and dividends. Quality and value will be emphasized more. Good companies will still be profitable. While their prices may come down, albeit not as much as others, strong companies tend to perform and the adage “a flight to quality” comes to the forefront.

There are always opportunities for money managers to buy stocks at a discounted value. The deeper the decline, the greater the opportunity. Since fundamentals are important, healthy stock company prices eventually reach their bottom and then bounce back. When choosing to invest with professional money managers such as mutual funds and managed accounts, they make investment decisions about these companies with discretion. If you are sitting on cash and want to emphasize the long-term part of your portfolio, you can buy a greater quantity of growth company shares at lower prices today.

Markets are cyclical and hard to predict in the short-term. As noted earlier, markets will rebound before the economy. Historically, when markets do rally, the biggest push is right at the beginning of the rebound. As an investor, rather than responding at that time you want to be there when they do. The chart below is one we will refer to as the economy draws questions. It emphasizes the historical size and time we spend in bull (strong) market vs. bear (weak) markets.

The United States stock market is the greatest wealth engine ever invented. Wealth is created over time and has very little to do with market timing. By staying invested, you pursue your needs, wants, and wishes over time.

This does not rule out the need for rebalancing and getting your current risk tolerance and risk capacity aligned with your investment portfolio. Please reach out to us if you want to have a deeper discussion about what is right for you.

Notable Quote

This great quote comes from none other than Warren Buffet himself. In times like these, it seems to be applicable as it relates to the current stock market downturn.

“Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

With gratitude to serve your financial interests,

Your partners at MGFS