What’s on your mind?

One word says it all “Everything!” So, let us go through potential challenges and our thoughts.

Challenges

- Are the banking issues isolated or are there more systemic problems like those associated with Silicon Valley Bank (SVB)?

- Will inflation ever get back to the normalized 2-2.5% range that the Federal Reserve is targeting?

- Will there be a recession and, if so, when is it coming? Will it be mild, moderate, or severe?

- Is there any foreign news that could impact the markets this year?

- Will the markets be impacted later this year by a government stalemate associated with the debt ceiling?

- Will stocks and bonds continue to be volatile in 2023?

Thoughts

- Regarding our country’s banks and their balance sheets, the government has taken measures to fortify this sector of the market and to backstop the institutions they deem as ‘too big to fail.’ It is possible a delayed impact from the few bank closures on related companies and industries may be felt over the summer. In turn, this may cause moderate volatility for stocks at that time.

- Inflation is declining although it is higher than the Fed target rate with the March CPI at 5.2%. Food and shelter prices are elevated more than other products and services. This coupled with higher interest rates and more expensive access to capital and loans makes us, consumers, feel like inflation hasn’t come down. As well, gas prices are increasing due to lower global supply from countries like Saudi Arabia.

- On May 3, as expected, the Fed raised interest rates (the Fed fund rate) by .25%, due to inflation and partly the need for JP Morgan to absorb First Republic Bank and instill public confidence in regional bank stability. We expect the Fed to pause for a while. We do not expect the Fed to raise rates as frequently or to the extent they did in 2022. Bond and stock markets should stabilize over time.

- While many economic pundits are still predicting a recession later this year or next, the consensus for now is for a mild one. Unemployment numbers are at all-time lows, but inflation rates exceeded wage rates. Mixed data such as this makes us feel, as well-known JP Morgan economist David Kelly suggests, that the economic outlook is “swampy.” We believe this is significantly better than a deep recession like standing at the end of a ledge where a fall would have grave consequences. Rather “swampy” portrays murkiness, where there are some dry spots for refuge with deeper areas to wade through while the overall landscape is a bit unclear.

- From the geo-political standpoint, as the war in Ukraine continues, the markets seem to be indifferent at this point. However, recent news regarding Russia’s global leadership in processing and refined uranium may require us to take pause. China/Taiwan, China/Russia, Russia/Iran, Saudi/Iran/Syria are all areas of interest. Their braiding between economics and Nation/State politics serves as a reminder of our past. For now, things are status quo.

- While there is significant political finger pointing and posturing, we expect the debt ceiling issue will be resolved later this year, perhaps at the last minute or beyond. Unless resolved, this may cause greater market volatility.

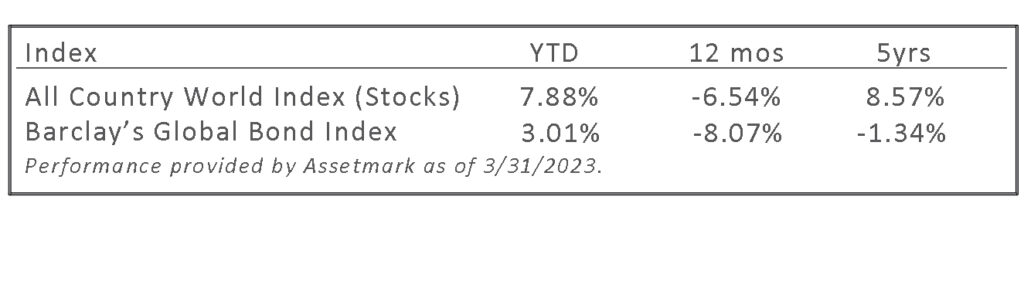

- The markets are off to a respectable first quarter with positive results.

Bonds are expected to have a better year in 2023 as interest rates stabilize. With higher interest rates, bond managers now have more ways to grow and protect your wealth. We are watching the impact of companies and the US reissuing debt or bonds at higher interest rates. While good for the investor, the entities carrying higher payment obligations may experience greater challenges with profitability.

This leads us to our views on equities. We would not be surprised if stocks/companies experienced volatility due to capital structure dilemmas like having to pay higher rates on loans to investors among other external factors. We pair such concerns with optimism around many companies streamlining their operations and expenses to run efficiently.

Strategies

- Stay invested, although reassess your risk tolerance and risk capacity with us. After stock markets decline, they can rebound quickly and historically the biggest part of their recoveries are typically at the beginning of new rallies. While the economy is sluggish and the markets may be choppy in the short term, we are still bullish in the long term. Allowing us to reaffirm both your needs and your portfolio’s capacity to support them will help us with your diversification.

- Over the next 12-18 months we encourage dollar-cost-averaging, gradually investing new money into the new market. This minimizes market timing risks and invests capital over time.

- We believe that new ideas will drive corporate profits and lead the private sectors to new heights. Well managed large corporations with strong balance sheets and lower debt are often the companies that best navigate recessions when they occur.

- Your managed accounts are rebalanced regularly. If you are planning for or taking income or distributions from your account(s), we may need to rebalance them to keep your income and growth strategies in check. Call us if you’d like to set up a call or meeting. Otherwise, we will be in touch to do the same.

- We are always researching and speaking with our strategic partners to incorporate relevant and unique investment or insurance strategies within your portfolio. Last year, for many of you we incorporated managed futures, a put-write strategy, and short duration fixed income to expand your diversification; this year, if appropriate, we are implementing a small weighting to another unique strategy, Stone Ridge, as a liquid alternative.

- Rates have risen over 5% over the last year, providing better opportunities with fixed income today.

- For future income and estate planning, Roth conversions, while available, continue to be an effective way to prepay taxes and potentially distribute assets tax-free. This strategy makes sense for some but not all clients.

- Tax management strategies such as tax budgeting and gains and loss harvesting may improve your bottom-line performance in the near term and over time. For example, in 2022, losses were significant, and taxes may have been high due to portfolio managers changing their preferred investments, selling securities with long-term capital gains. In many instances we sold securities with losses to offset gains and minimize taxes. Tax savings should be viewed as a return of your assets and improved performance. Our book, Guided Retirement Income Planning introduced the concept of flooring strategies, to provide guaranteed income for essential expenses and peace of mind. There are new products available that are quite innovative. Call us for a copy or go to Amazon.com. Our intent is to help you with pre and early retirement planning.

Notable Quote

Here is an excellent and relevant quote from legendary fund manager Peter Lynch about investing in the stock market.

“People who succeed in the stock market also accept periodic losses, setbacks, and unexpected occurrences.”

The market is currently performing in sharp contrast to last year. Please remember, saving is for the short term and investing is for the long-term. If your circumstances are changing, we will look forward to speaking with you at your convenience.

Thank you once again for your trust in us. We are grateful to being able to serve your financial needs.

Your investment partners – Adam, Barry, and To